Understanding UPI: India’s Payment Revolution and Its Global Implications

The global payments landscape is evolving rapidly, with digital transactions becoming a cornerstone of modern economies. While U.S. platforms like PayPal, Venmo, and Zelle dominate locally, India’s Unified Payments Interface (UPI) has emerged as a global pioneer in digital payment systems. UPI has not only transformed India’s economy but also offers valuable insights for the U.S. and beyond.

In this article, we’ll explore what UPI is, its revolutionary impact, and why its success story is significant for American audiences.

Table of Contents

ToggleWhat is UPI?

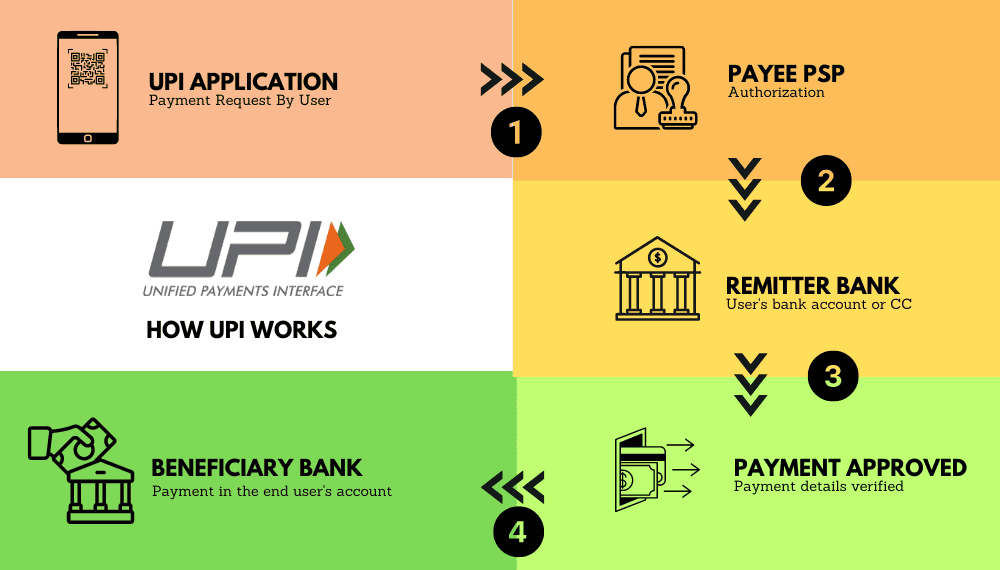

The Unified Payments Interface (UPI) is a real-time payment system developed by the National Payments Corporation of India (NPCI) in 2016. It facilitates instant money transfers between bank accounts using a smartphone. With UPI, users can send and receive money 24/7 without needing complex banking details. Transactions are secured by two-factor authentication, ensuring user safety and trust.

Why is UPI Revolutionary?

UPI’s innovation lies in its simplicity and inclusivity, enabling financial access for millions of Indians. Let’s break down what makes UPI so transformative:

- Interoperability Across Platforms

UPI operates as an open ecosystem, allowing users of different apps like Google Pay, PhonePe, and Paytm to transact seamlessly.

Example: A merchant in India can display a single QR code for UPI payments. Customers using any UPI-enabled app can scan the code and pay instantly, without worrying about compatibility. - Ease of Use

Users only need a Virtual Payment Address (VPA), typically linked to their phone number, to make transactions. This eliminates the need for long bank account numbers or IFSC codes. - Cost-Effectiveness

UPI transactions are either free or incur minimal costs for users, promoting widespread adoption across income groups. - Multi-Purpose Applications

Beyond person-to-person payments, UPI supports bill payments, online shopping, and even cashless transactions in rural markets.

Example: During the COVID-19 pandemic, UPI enabled contactless payments for online grocery deliveries, offering a safe and efficient solution for both customers and merchants.

How UPI Differs from U.S. Payment Systems

While the U.S. has robust payment platforms like Venmo, Zelle, and PayPal, they operate in closed ecosystems. UPI’s interoperability and government-backed infrastructure set it apart. Unlike most U.S. systems, UPI allows transactions across different apps and banks without additional fees, making it more inclusive and accessible.

What Can the U.S. Learn from UPI?

UPI’s success offers valuable lessons for the U.S. fintech industry:

- Focus on Financial Inclusion

UPI has brought millions of unbanked individuals into the formal economy by simplifying payments and ensuring accessibility. Similar initiatives in the U.S. could address financial gaps in underserved communities. - Encourage Interoperability

By enabling multiple apps and banks to collaborate, UPI has created a unified system that benefits users and merchants alike. This could inspire U.S. platforms to reduce silos and improve user convenience. - Government-Private Collaboration

India’s government played a crucial role in launching UPI. A collaborative approach in the U.S. could accelerate innovation and adoption of universal payment standards.

Why Should Americans Care About UPI?

UPI is influencing global payment trends, with countries like Singapore and the UAE adopting UPI-like frameworks or partnering with India for cross-border payments. Understanding UPI’s model can help U.S. businesses prepare for opportunities in global trade and travel.

Moreover, as digital payments grow, UPI showcases how technology can enhance convenience, security, and financial inclusion simultaneously.

Conclusion

India’s UPI has set a new standard for digital payment systems, emphasizing simplicity, interoperability, and inclusivity. As the U.S. looks to enhance its payment infrastructure, UPI’s success offers a valuable blueprint.

By learning from UPI, the U.S. can pave the way for a more seamless, cost-effective, and inclusive payment ecosystem—one that meets the needs of both businesses and consumers in an increasingly digital world.